By: Bakinam Khaled

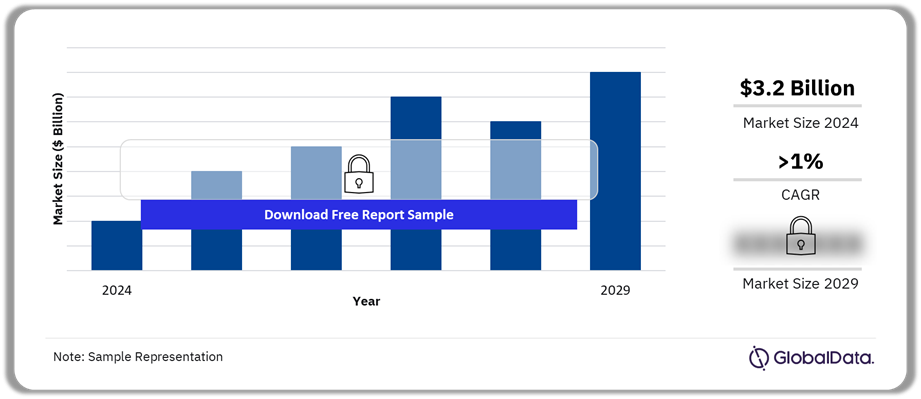

New Zealand’s mobile services revenue is poised to grow at a modest compound annual growth rate (CAGR) of 1.5% from $1.5 billion in 2024 to $1.6 billion in 2029, mainly supported by the growth in mobile data service segment. Rising 5G adoption, expanding M2M/IoT deployments, and surging data consumption underscore a shift toward digital connectivity, as operators modernize networks and cater to the evolving consumer and enterprise demands across the telecom landscape, says GlobalData, a leading data and analytics company.

GlobalData’s New Zealand Mobile Communications Forecast model (Q1 2025) reveals that mobile voice service revenue will decline at a CAGR of 2.1% over the forecast period due to the increasing consumer preference for over-the-top (OTT) communication platforms, and the decline in voice average revenue per user (ARPU) levels.

Mobile data service revenue, on the other hand, is expected to increase at a CAGR of 4.4% over the forecast period, driven by the steady growth in mobile internet subscriptions, especially on 4G/5G networks, and increase in mobile data ARPU.

Sarwat Zeeshan, Telecom Analyst at GlobalData, comments: “The average monthly data usage over mobile networks is forecast to increase from 7.68GB in 2024 to 14GB in 2029, driven by the increasing consumption of online video and social media content over mobile network on the back of 4G/5G service expansions across the country, and the data-centric plans offered by MNOs.”

GlobalData expects 5G service adoption to increase over the forecast period, driven by the growing consumer demand for high-speed connectivity, wider availability and affordability of 5G service plans, ongoing 5G network expansions and upgrades by telcos, and the planned shutdown of 2G/3G networks by 2025-end to boost subscriber migration to 5G services.

For instance, 2degrees announced a five-year extension to its existing joint RAN technology in partnership with Ericsson in July 2024 to accelerate its 5G rollout across New Zealand and modernize its network with advanced 5G infrastructure.

M2M/IoT subscriptions are set to increase at a CAGR of 2% over 2024-2029 as the commercial adoption of M2M/IoT solutions offered by telcos such as IoT led-fleet management and asset management gain traction. For instance, One New Zealand offers Asset Management IoT solution that helps track, monitor and optimise valuable physical assets, from anywhere.

One New Zealand led the mobile services market, by subscription share in 2024, and will maintain its leadership through 2029, given its ongoing mobile network expansion and modernization efforts. The operator also has a dominant position in the growing M2M/IoT market, thanks to its strong focus on innovative M2M/IoT services to drive opportunities in the enterprise segment.

Zeeshan concludes: “The growing demand for high-speed connectivity and enterprise-grade IoT solutions will be pivotal in reshaping New Zealand’s mobile landscape. Operators that prioritize network modernization, spectrum efficiency, and tailored data-centric offerings will be best positioned to capitalize on the evolving usage patterns and unlock long-term revenue potential.”